Step by Step Guide for PTA's to E-File Form 990-N

It's easy to e-file Form 990-N with File990forPTA. Just follow the steps mentioned below and transmit your returns to the IRS in just a few minutes.

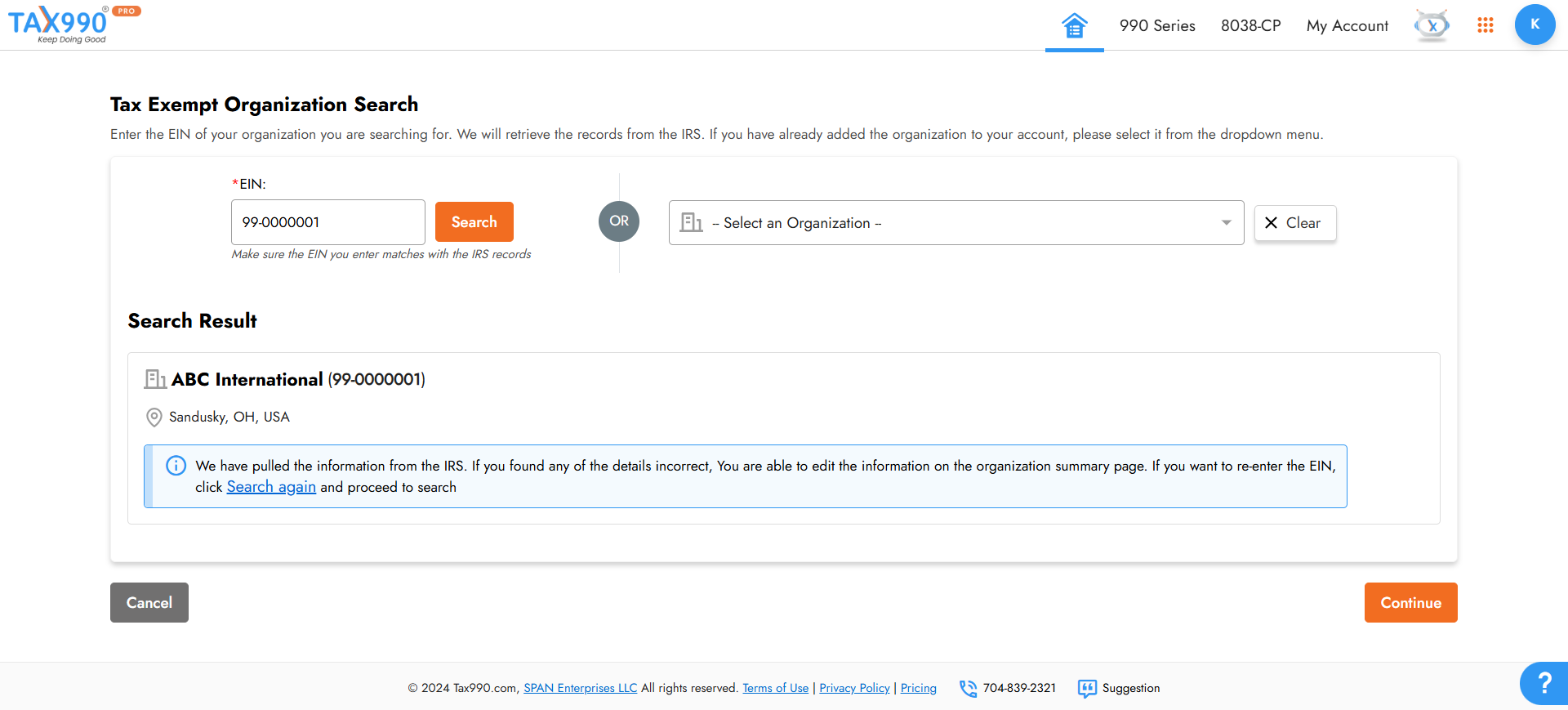

Step-1: Search Organization’s EIN

Just search for your EIN, and our system will automatically import your organization’s data from the IRS.

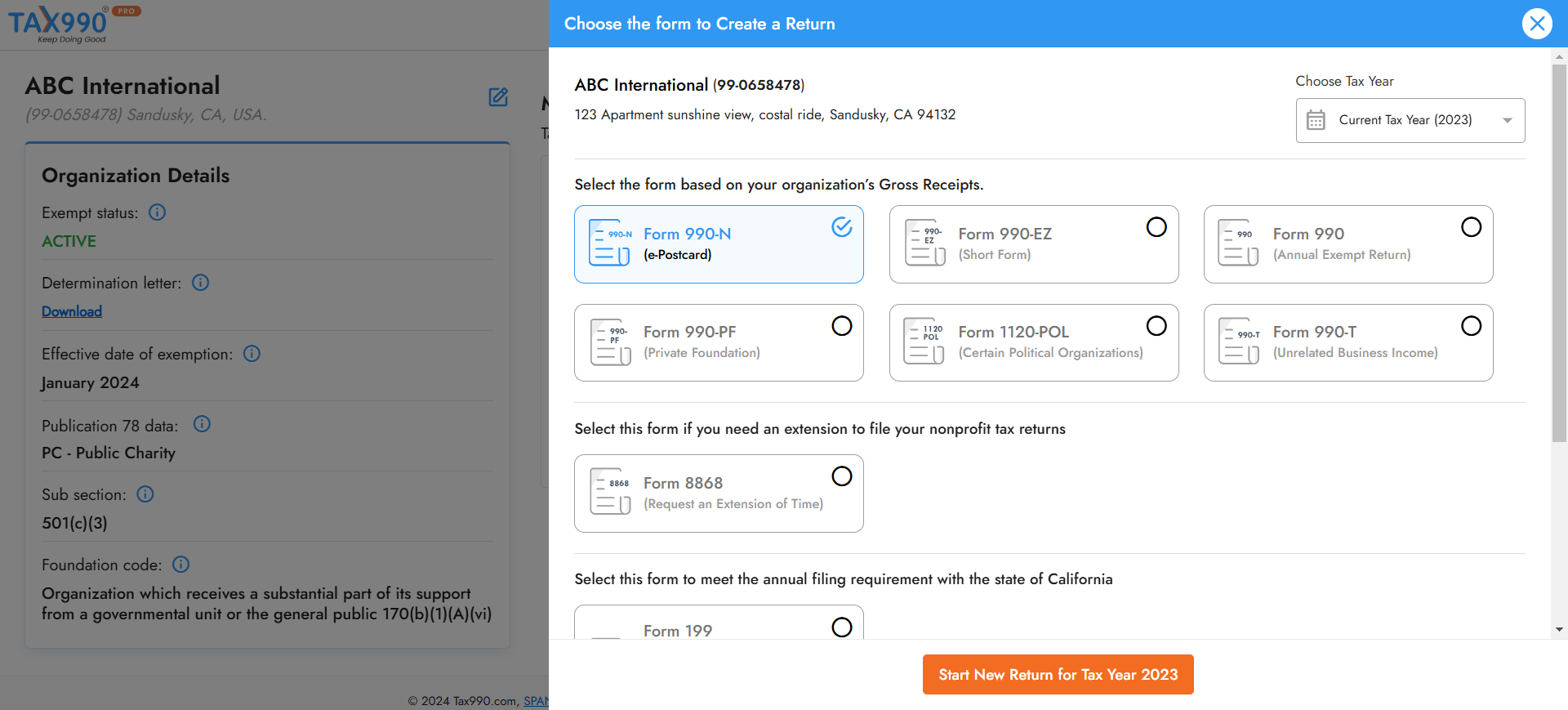

Step-2: Choose Tax Year

Tax 990 supports 990-N filing for the current and previous tax years. Choose the applicable tax year, select Form 990-N, and proceed.

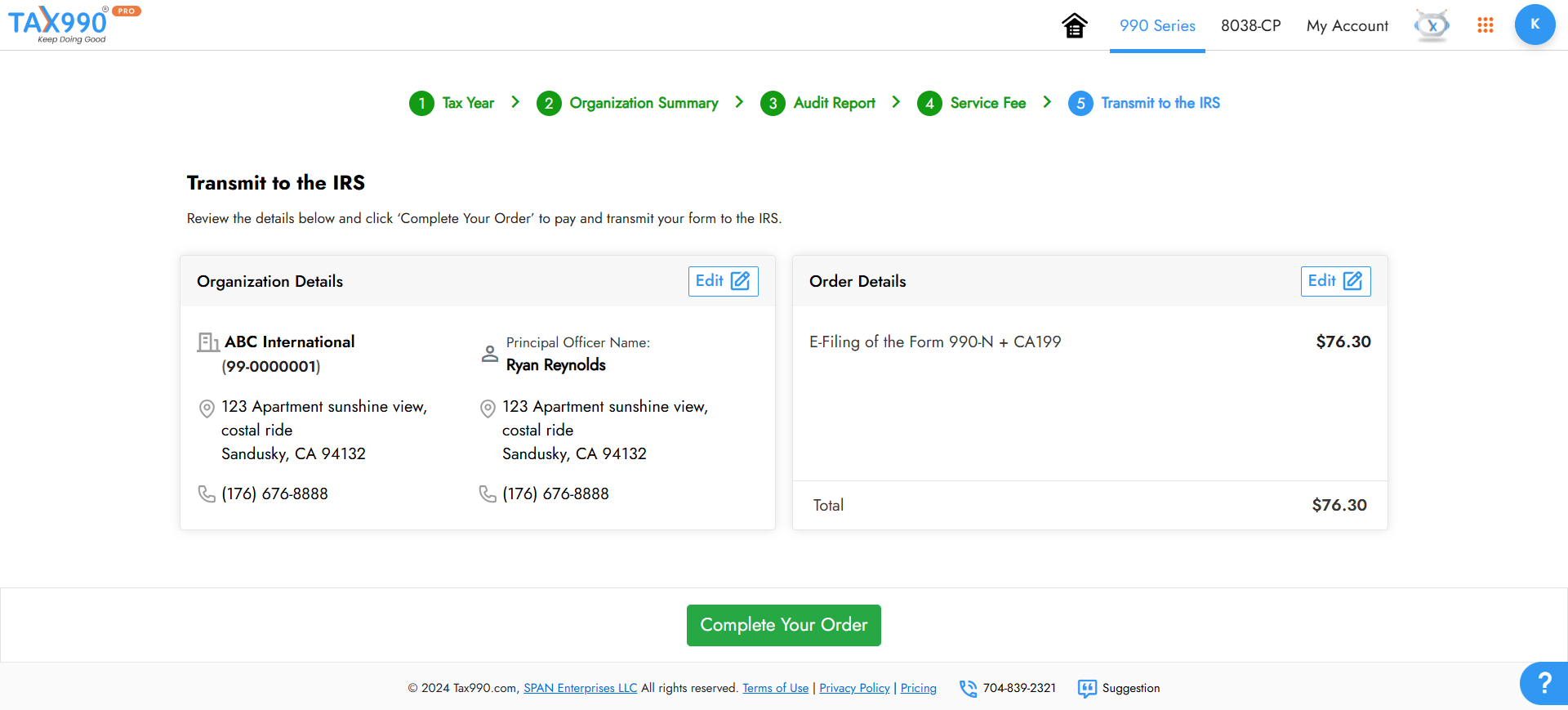

Step-3: Review and Transmit it to the IRS

Once you have reviewed your form, you can transmit it to the IRS. Our system will update you on your form status via email or text.